ALDORA’s first set of 2026 data is already revealing a defining shift in franchise competition: the most momentous franchises no longer rely on major launches to sustain cultural and commercial relevance. Today, even seemingly small touchpoints can generate meaningful momentum, proving that true franchise strength is defined by who wins between releases.

This month’s strongest performers climbed the charts through continuous lifecycle touchpoints, not one-off releases. And while the industry still celebrates milestone launches, audiences reward persistent presence—sustained through updates, anniversaries, revivals, and cross-platform engagement that keeps franchises culturally and commercially relevant between major content drops.

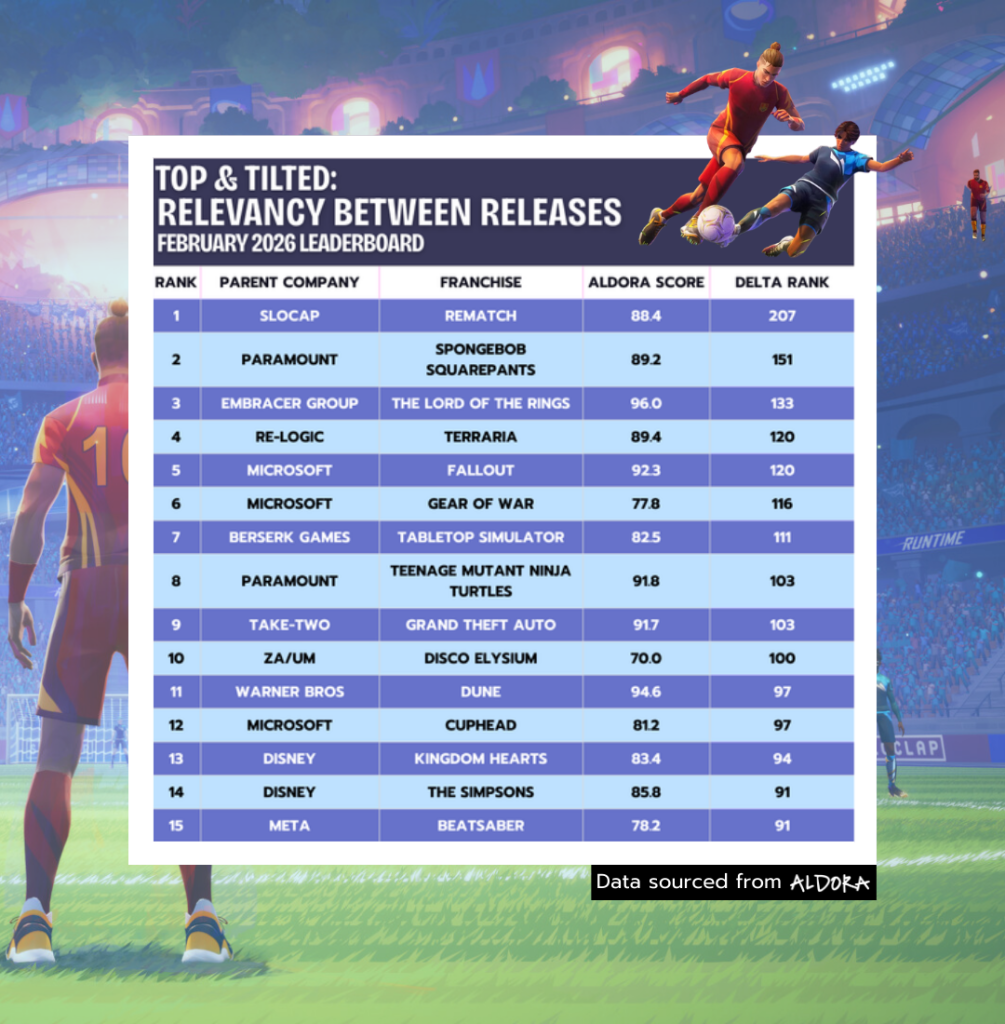

About this month’s leaderboard: February’s rankings are based on January data and focus specifically on trending franchises, or those exhibiting the greatest positive month-over-month rank movement relative to the prior period.

Leaderboard Terms:

ALDORA Score: A normalized monthly score (0–100) that ranks franchises based on aggregated performance across five behavioral dimensions: Play, Watch, Connect, Create, and Spend.

Delta Rank: The net change in position across all five behavioral dimensions, capturing the overall directional shift in franchise engagement rather than isolated category movement.

REMATCH (#1) leads this month’s trending leaderboard with an ALDORA Score of 88.4 and a Delta Rank of 207. Following its December release of season two, developer Slocap sustained engagement through rapid fix updates and live-service improvements. Its performance reinforces a broader structural shift in gaming: launch windows now serve as entry points rather than peak-engagement moments. REMATCH’s continued upward movement demonstrates how post-release iteration and community responsiveness can drive sustained momentum well beyond initial launch cycles.

Paramount’s SpongeBob SquarePants (#2) posts an ALDORA Score of 89.2 and a Delta Rank of 151 following the digital release of its latest film sequel on January 20. The franchise continues to demonstrate rare cross-generational staying power across streaming, merchandise, gaming, and creator ecosystems. Bonus content—such as an Ice Spice music video—signals how music and creator partnerships are becoming core tools for sustaining franchise relevance.

Embracer Group’s The Lord of the Rings (#3) leads this month with the highest ALDORA Score at 96 and a Delta Rank of 133. The franchise’s 25th-anniversary theatrical re-release demonstrates how legacy IP can re-engage audiences through strategic rediscovery. LOTR continues to exemplify how franchise capital compounds, with each revival expanding engagement across viewing, fandom, and merchandise.

Elsewhere on the leaderboard, community-driven and live-service platforms continue to demonstrate durable engagement patterns. Terraria (#4, 89.4 ALDORA Score, 120 Delta Rank) surged following the release of its major 1.4.5 “Bigger & Boulder” update, showcasing how developer commitment to post-launch support sustains long-tail player investment. Similarly, Tabletop Simulator (#7, 82.5, 111 Delta Rank) benefits from announced platform improvements that reinforce its role as an evergreen creator and social play environment.

Microsoft’s franchise portfolio demonstrates ecosystem-level orchestration across multiple properties this month. Fallout (#5, 92.3, 120 Delta Rank) gained momentum through Xbox Free Play Days for Fallout 76 alongside community-generated content expansion for Fallout 4. Meanwhile, Gears of War (#6, 77.8, 116 Delta Rank) rose on confirmation of its 2026 release, proving that signaling future content can be as powerful as launching it. Cuphead (#12, 81.2, 97 Delta Rank) reinforces the publisher’s ability to maintain engagement across stylistically distinct properties that sustain both nostalgic and creator-driven participation.

Paramount appears again with Teenage Mutant Ninja Turtles (#8, 91.8, 103 Delta Rank), supported by the announcement of a second season of Tales of the Teenage Mutant Ninja Turtles. The franchise’s consistent cross-format storytelling reinforces Paramount’s expanding ability to transform legacy animation IP into multi-surface engagement ecosystems.

Take-Two’s Grand Theft Auto (#9, 91.7, 103 Delta Rank) continues to benefit from sustained player engagement and social visibility, underscoring Rockstar’s longstanding strength in maintaining cultural relevance between major franchise entries.

Legacy IP revival continues to be a powerful driver of engagement across entertainment. Warner Bros.’ Dune (#11, 94.6, 97 Delta Rank) surged following the announcement of its next film release date, while Disney’s Kingdom Hearts (#13, 83.4, 94 Delta Rank) leveraged collectible merchandise activation through a limited-edition Keyblade pin series. The Simpsons (#14, 85.8, 91 Delta Rank) similarly demonstrates how long-running franchises can sustain attention through predictive cultural commentary and social discourse.

Independent and community-driven storytelling continues to shape cultural momentum. ZA/UM’s Disco Elysium (#10, 70, 100 Delta Rank) saw renewed engagement following announcements surrounding new creative leadership developments and progress across Disco-inspired narrative RPG projects, highlighting how creator-driven narrative IP can sustain relevance through development visibility and community interest. Meta’s Beat Saber (#15, 78.2, 91 Delta Rank) continues to benefit from expanding VR participation and deeply entrenched user-generated content ecosystems.

Collectively, this month’s leaderboard exposes a fundamental rule change in franchise competition. Launches don’t exclusively drive success. Momentous participation ecosystems do. Today, launches are sparks. The real winners are the ones who keep the fire burning.

ALDORA tracks brand performance across five dimensions of the gaming ecosystem—Play (direct gameplay), Watch (streaming and video content), Connect (social interactions), Create (user-generated content), and Spend (in-game purchases and merchandise)—aggregating these diverse engagement signals into a unified measure of audience reach.

KEY INSIGHTS

1. The lifecycle has replaced the launch as gaming’s primary growth engine.

February’s leaderboard reinforces a structural shift in how franchises build and sustain momentum. Slocap’s REMATCH (#1, 88.4, 207 Delta Rank) continues growing post-launch with iterative updates, Re-Logic’s Terraria (#4, 89.4, 120 Delta Rank) surged following the “Bigger & Boulder” update, and Microsoft’s Fallout (#5, 92.3, 120 Delta Rank) leveraged Free Play Days and new community content to re-engage audiences. These examples demonstrate that competitive advantage increasingly accrues to franchises that operate as ongoing services.

The industry historically optimized for momentary demand spikes. Audiences now reward continuous relevance. The franchises that win are those that consistently create reasons to return, participate, and contribute.

2. Franchise value no longer decays between releases. It compounds through revival cycles.

The performance of Embracer Group’s The Lord of the Rings (#3, 96, 133 Delta Rank), Warner Bros’ Dune (#11, 94.6, 97 Delta Rank), Paramount’s SpongeBob SquarePants (#2, 89.2, 151 Delta Rank), Paramount’s Teenage Mutant Ninja Turtles (#8, 91.8, 103 Delta Rank), and Disney’s Kingdom Hearts (#13, 83.4, 94 Delta Rank) demonstrates how legacy franchises continue to accumulate cultural and commercial capital through strategic reintroductions, anniversary programming, merchandise activation, and streaming distribution.

Rather than fading between installments, these franchises monetize familiarity and emotional continuity. Legacy IP increasingly behaves like an annuity stream, where each revival reactivates dormant audiences while onboarding new generations across platforms and formats.

3. Ecosystem orchestration is overtaking single-IP strategy as the dominant competitive advantage.

Microsoft’s multi-franchise footprint (Fallout, Gears of War #6, 77.8, 116 Delta Rank, Cuphead #12, 81.2, 97 Delta Rank) illustrates how platform operators can sustain engagement through coordinated portfolio management across distinct IP. Simultaneously, community-driven ecosystems such as Terraria, Tabletop Simulator (#7, 82.5, 111 Delta Rank), Disco Elysium (#10, 70, 100 Delta Rank), and Beat Saber (#15, 78.2, 91 Delta Rank) demonstrate that creator participation, modding culture, and social play loops can rival traditional marketing scale in sustaining long-term engagement.

The competitive battleground is shifting from content ownership to audience orchestration. The organizations that connect play, viewing, creation, identity, and commerce into unified behavioral systems will define the next franchise leaders.

Attention is fleeting. Participation is power. Franchises that maintain touchpoints between releases turn both into enduring cultural gravity, and tomorrow’s winners will be those who never stop engaging.

Eager for next month’s leaderboard? Follow ALDORA on LinkedIn to be the first to see where culture, capital, and consumer power collide next.

Analysis by ALDORA CEO Joost van Dreunen

Contact

ALDORA

🌐 www.aldora.io

📍 Brooklyn, NY