Report:

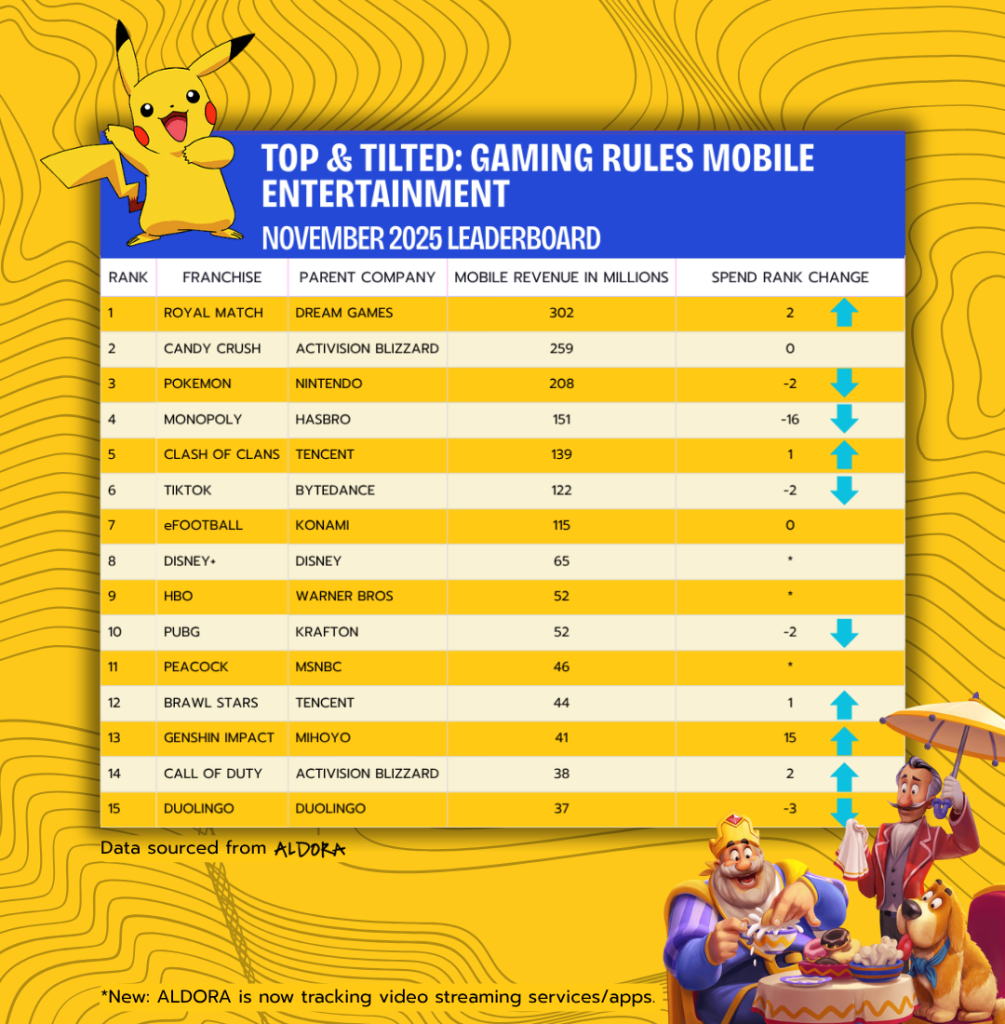

In October 2025, mobile spend across the top 15 franchises surpassed $1.5 billion. Mobile gamers accounted for a staggering 81% of that spend—proof that mobile is more than just a platform; it’s where culture, capital, and consumer power converge. Curious about the numbers? We’ve got them.

This month’s leaderboard signals a fundamental shift in consumer behavior: audiences are moving toward experiences where they can play, connect, and interact—not just passively watch. And they’re putting their money where their time is, proving that interactive entertainment outpaces streaming in both cultural influence and monetization.

The Breakdown

Royal Match (Dream Games) earned the #1 spot this month with $302M, up two rankings from last month. Candy Crush (Activision Blizzard, $259M) and Pokémon (Nintendo, $208M) rounded out the top three, demonstrating that classic IP still holds immense sway over audiences and their wallets. Tencent’s Clash of Clans ($139M) and Brawl Stars ($44M) also climbed the ranks, reinforcing that live-service, community-driven models turn engagement into sustainable capital.

Meanwhile, narrative-rich, globally accessible games are rising faster than ever: Genshin Impact ($41M) surged 15 spots to claim a top position on the leaderboard, proving that strong storytelling can convert audiences into paying, loyal communities even on mobile-first platforms.

Streaming platforms like Disney+ ($65M), HBO ($52M), and Peacock ($46M) continued to capture audience attention, but their mobile revenue lags behind that of interactive franchises. Unlike games, where engagement drives ongoing purchases, streaming revenue is largely passive and subscription-based. This gap spotlights a critical trend: in mobile entertainment, engagement drives both culture and cash flow.

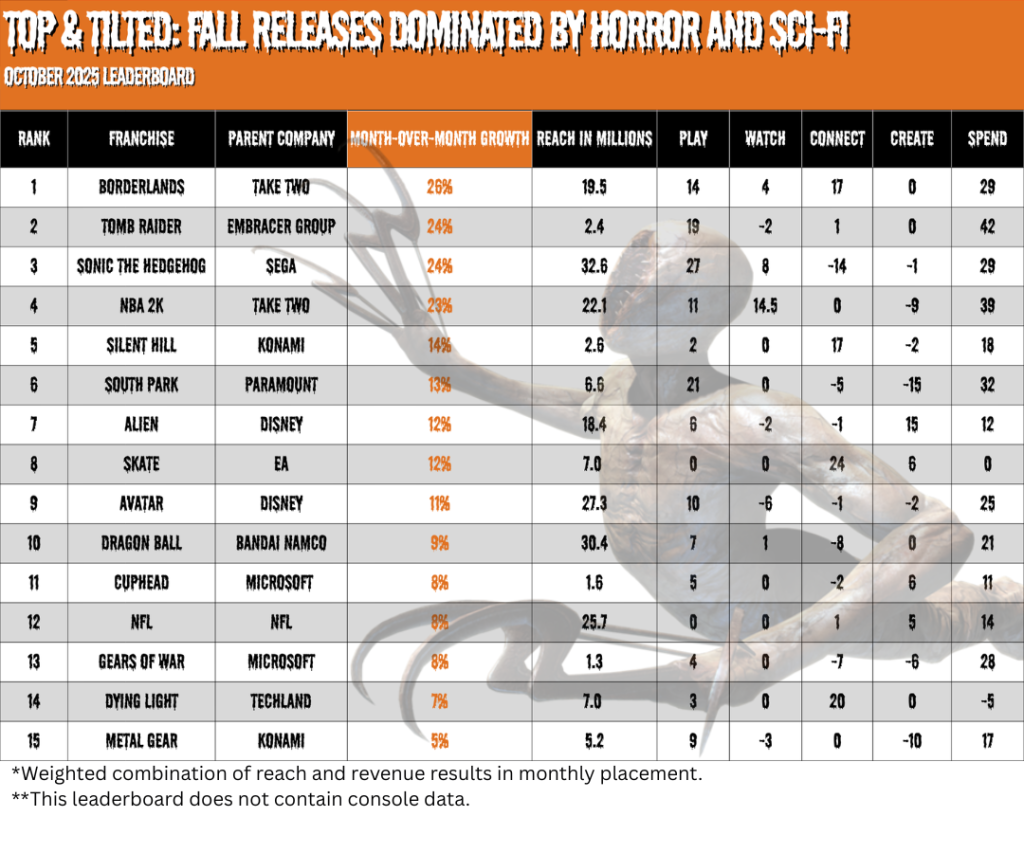

ALDORA tracks brand performance across five dimensions of the gaming ecosystem—Play (direct gameplay), Watch (streaming and video content), Connect (social interactions), Create (user-generated content), and Spend (in-game purchases and merchandise)—aggregating these diverse engagement signals into a unified measure of audience reach.

KEY INSIGHTS

Mobile IP Is the New Economic Engine.

Franchises like Royal Match ($302M), Candy Crush ($259M), and Pokémon ($208M) prove that well-designed mobile experiences can out-earn even the biggest streaming giants. Royal Match’s rise two ranks this month signals momentum, not luck, while Candy Crush and Pokémon show the enduring power of legacy IP to capture both engagement and spend.

Live-Service Communities Drive Revenue.

Clash of Clans ($139M) and Brawl Stars ($44M) illustrate how community investment translates directly into monetization. Players spend on cosmetic items, progression, and collaboration—and live-service ecosystems amplify that behavior.

Global, Narrative-Driven Titles Are the Future.

Genshin Impact’s ($41M) 15-spot jump shows that high-quality, story-driven mobile games can reach mass audiences and generate real economic impact.

Legacy IP Remains a Strategic Asset.

Classic franchises like Pokémon ($208M) and Candy Crush ($259M) remind the industry that retention, updates, and cross-promotional strategies still command serious engagement and revenue.

This month’s leaderboard confirms a new reality: spend follows engagement, and mobile is the battlefield where cultural relevance meets economic power.

Who will dominate next month? Follow ALDORA on LinkedIn to see where culture, capital, and consumer power collide next.

Analysis by ALDORA CEO Joost van Dreunen

Contact

ALDORA

🌐 www.aldora.io

📍 Brooklyn, NY